Imagine your bank account. It’s a safe, digital space where you store your money. Now, imagine a similar account, but instead of holding rupees, it holds your investments—stocks, bonds, mutual funds, and more. That, in essence, is a Demat Account. For anyone looking to invest in the Indian stock market, understanding the Demat account isn’t just useful; it’s the mandatory first step. This guide will demystify what a Demat account is, why it’s essential, and how you can open one to begin your journey of wealth creation.

Part 1: The Great Shift – From Paper to Digital

To truly appreciate the Demat account, we need a quick trip back in time. Not too long ago, investing in stocks was a cumbersome process involving physical paper. When you bought shares, you received a physical Share Certificate—an ornate piece of paper that was your legal proof of ownership.

This system was plagued with problems:

- Risk of Damage or Theft: Physical certificates could be lost, stolen, or damaged by fire or water, potentially wiping out your entire investment record.

- Forgeries: The system was susceptible to fake and forged certificates, leading to significant financial fraud.

- Slow Transactions: Transferring ownership involved sending certificates back and forth via post, a process that could take weeks or even months. This made it impossible to react quickly to market changes.

- Bad Deliveries: Mismatched signatures or torn certificates could result in a “bad delivery,” further delaying the process.

Recognizing these challenges, India embarked on a financial revolution. In 1996, the Dematerialisation system was introduced, allowing investors to convert their physical certificates into an electronic, or “dematerialized,” format. This single move paved the way for the modern, accessible, and secure stock market we know today.

The evolution from cumbersome physical shares to a secure, digital Demat system.

Part 2: The Three Pillars of Modern Investing

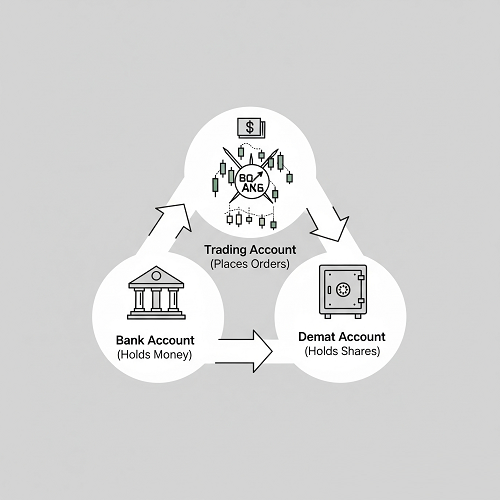

A Demat Account is the digital vault where your securities are held. However, to trade in the stock market, it works in tandem with two other crucial accounts. Understanding this “3-in-1” system is key to grasping how transactions flow.

1. The Demat Account

As we’ve established, this is your digital repository. When you buy shares, they are credited to your Demat account. When you sell them, they are debited from it. It holds your investments securely. In India, these accounts are maintained by two central depositories: the National Securities Depository Limited (NSDL) and the Central Depository Services Limited (CDSL). You, as an investor, interact with them through a stockbroker, who acts as a Depository Participant (DP).

2. The Trading Account

This is the account you open with a stockbroker (like Motilal Oswal). The Trading Account is your marketplace—it’s the platform you use to actually place buy and sell orders on the stock exchange (like the NSE or BSE). Without a trading account, you can’t participate in the market.

3. The Bank Account

This is your regular savings or current account. It provides the funds for your investments. When you buy shares, money is debited from your bank account. When you sell shares, the proceeds are credited back to this same bank account.

The seamless flow of money and shares between your three essential accounts.

Here’s how they work together in a simple table:

| Account Type | Primary Function | Analogy |

|---|---|---|

| Bank Account | Holds your money (Rupees). Used for funding purchases and receiving sales proceeds. | Your Wallet |

| Trading Account | The platform to place Buy & Sell orders on the stock exchange. | The Marketplace or Shopping Cart |

| Demat Account | Holds your purchased securities (Stocks, Bonds, ETFs) in a digital format. | Your Secure Vault or Locker |

Part 3: The 6 Undeniable Reasons You Need a Demat Account

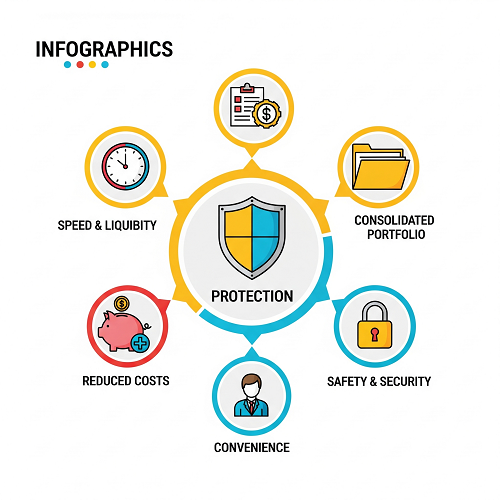

Opening a Demat account is not just a regulatory requirement; it brings a host of powerful benefits that make investing efficient, secure, and accessible for everyone.

A Demat account offers unparalleled safety, speed, and convenience.

1. Unmatched Safety and Security

This is the most significant advantage. Digital securities held in a Demat account eliminate all the risks associated with physical certificates. There is no danger of theft, loss, damage, or forgery. Your investments are securely recorded in a centralized depository system, accessible only by you through a secure login process.

2. Supreme Convenience

Gone are the days of paperwork and postal delays. With a Demat and Trading account, you can buy or sell shares, mutual funds, and other securities from the comfort of your home or on the go using a mobile app. Your entire investment portfolio can be viewed and managed from a single screen.

3. Instantaneous Transactions and Liquidity

In the physical era, selling shares could take weeks. Today, when you sell shares, they are instantly debited from your Demat account, and the funds are credited to your bank account within T+1 days (Trading day plus one day). This speed allows you to react quickly to market opportunities and provides much greater liquidity for your investments.

4. A Single Hub for All Your Investments

A common misconception is that a Demat account is only for stocks. In reality, it’s a versatile vault that can hold a wide array of financial instruments:

- Equity Shares

- Mutual Funds

- Exchange Traded Funds (ETFs)

- Corporate and Government Bonds

- Government Securities (G-Secs)

- Sovereign Gold Bonds (SGBs)

This allows you to consolidate your entire investment portfolio in one place, making it incredibly easy to track and manage.

5. Reduced Costs and Hassle

The transfer of physical shares involved paying stamp duty, a significant cost that has been eliminated in the electronic system. Furthermore, you avoid the costs and hassles associated with postage, courier services, and tracking physical documents.

6. Effortless Corporate Actions

What happens when a company you’ve invested in declares a dividend, announces a stock split, or issues bonus shares? With a Demat account, these “corporate actions” are handled automatically. Dividends are directly credited to your linked bank account. Bonus shares or split shares are automatically credited to your Demat account. You don’t have to do any paperwork or chase any payments.

Part 4: Your 5-Minute Path to Becoming an Investor

Opening a Demat and Trading account has never been easier thanks to the fully digital e-KYC (Know Your Customer) process. Here’s a simple overview of the steps:

- Choose Your Stockbroker (Depository Participant): This is your most important choice. A good broker, like Motilal Oswal, not only provides a platform but also offers crucial research, tools, and support to guide your journey.

- Keep Your Documents Ready: You will typically need digital copies of your PAN Card, Aadhaar Card (linked with your mobile number), Proof of Address, Bank Proof (like a cancelled cheque or bank statement), and a clear image of your signature on a white paper.

- Fill the Online Application Form: The process is entirely online and takes just a few minutes.

- Complete Aadhaar e-Sign and e-KYC: You will verify your application by entering an OTP sent to your Aadhaar-linked mobile number.

- In-Person Verification (IPV): This mandatory step is now completed via a quick online video call where you show your original documents.

Once these steps are done, your account is typically verified and activated within 24-48 hours, and you are ready to make your first investment!

Ready to Take the First Step?

The journey to wealth creation begins with opening your first investment account. Get access to a 3-in-1 Demat, Trading, and Bank account powered by expert research and cutting-edge technology.